By Daniel Rodriguez | Dr. Budgets

By Daniel Rodriguez | Dr. Budgets

Have you heard of the Rule of 72? According to Wikipedia, it is a method of estimating an investment’s doubling time. This rule is useful for quick calculations.

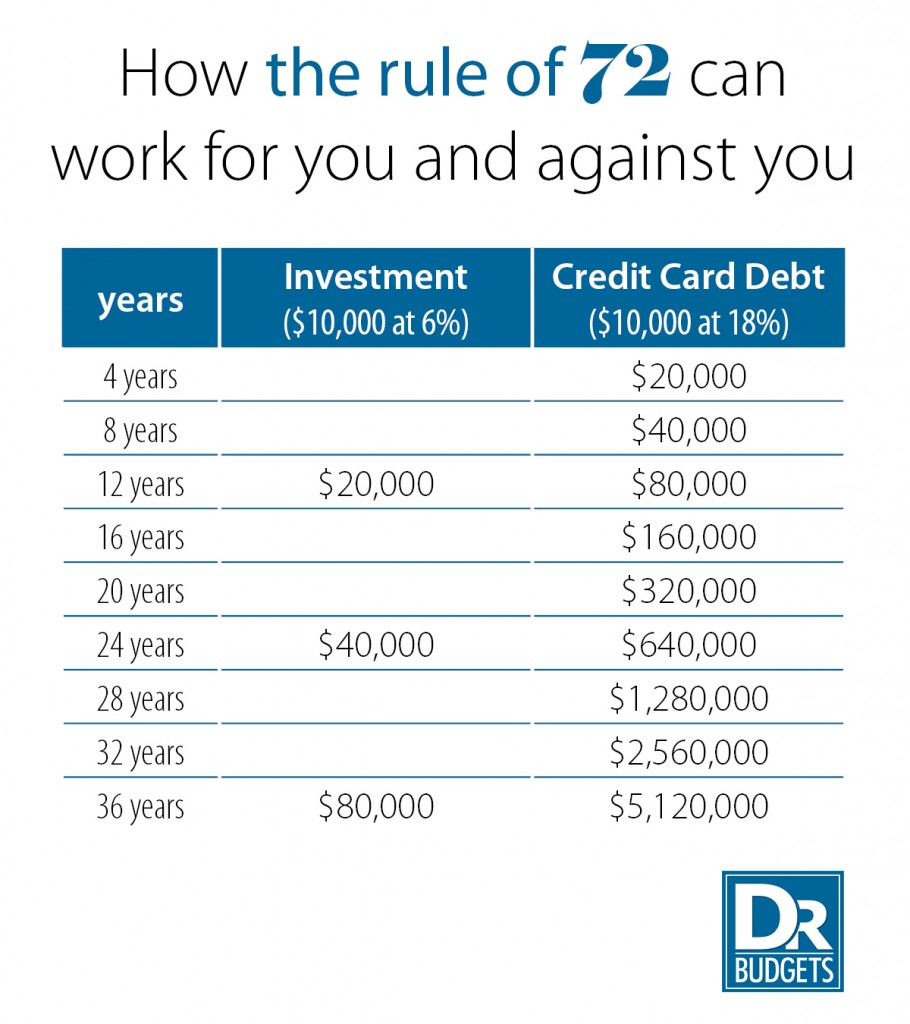

For example, if you invested $10,000 today at a 6% return, the Rule of 72 determines that your investment would double to $20,000 in 12 years (72 ÷ 6 = 12). Taking this a step further, your investment would double to $40,000 in 12 additional years. So in 24 years your investment would have quadrupled from $10,000 to $40,000! As you can see, this is a very simple and easy way for you to determine how quickly you can grow your wealth.

Unfortunately, when you hold high interest DEBT, such as credit card debt, the Rule of 72 works against you. Let’s say you carry $10,000 in debt today at an 18% interest rate, and you don’t pay down the balance. In this scenario your debt would DOUBLE to $20,000 in 4 short years (72 ÷ 18 = 4), then DOUBLE again to $40,000 in 4 more years. After 12 years your original $10,000 in debt would have ballooned to $80,000!

If you were to compare the $10,000 investment to the $10,000 debt balance over time, this is what it would look like in 36 years:

This table illustrates why it is so important to pay off your high interest credit card debt before you do anything else. This is also why it is so difficult to get out of credit card debt when you get in it too deep.

Is getting out of debt one of your goals? You are not alone – over 70% of Dr. Budgets’ clients contacted us to help them create a healthy spending plan to pay off their debt once and for all. Most often, though, “staying on track” with your plan is the hard part – so, to be successful most clients rely on a budget coach to hold them accountable to their spending plan.

Are you ready to get out of credit card debt and start making the Rule of 72 work FOR you? If so, call us today at 619-800-3030 to get started. For easy savings tips, “Like Us on Facebook” and subscribe to our monthly newsletter.